- Ziya Gökalp Mahallesi Süleyman Demirel Bulvarı Mall Of İstanbul Offıce Binası Kat:18 No:139 Başakşehir/İstanbul

- info@24portfoy.com.tr

24 Portföy

Our company was established in 2015 to operate in the field of Portfolio Management within the body of the 24 Group, which develops luxury residences, offices and mixed projects with nearly 25 years of experience in the construction and real estate sector. Our company, which established and manages the Real Estate Investment Fund and Venture Capital Investment Fund, has established 14 REIFs and 8 VCIF and continues its activities with a total of 22 funds.

Real Estate Investment Funds

To maximize the total value of the fund with the management of REIF, Real Estate and Real Estate-based rights, to ensure high returns for its investors

Private Equity Investment Funds

VCIF is to support the growth and branding of non-public companies with high growth potential by investing in Joint Stock and Limited Companies. We aim to provide high returns to our investors in the coming period, as in the past, with our funds managed on a participation basis.

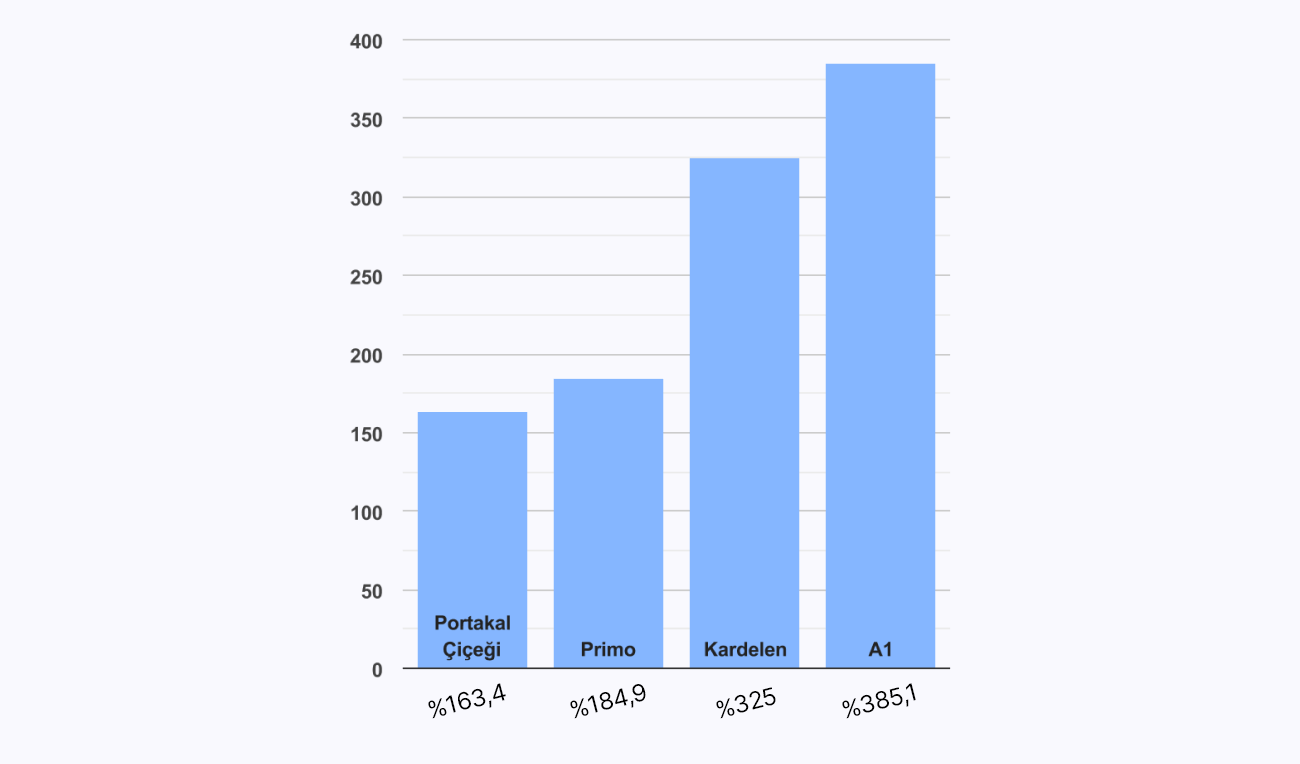

Some of our funds with annual returns exceeding 100%.

24 Portfolio is one of the first companies to establish a real estate investment fund and has been far ahead of other funds in its field in terms of performance in terms of 2022 return and total return of our funds since its establishment. Considering the 2022 returns of the Investment Funds established by 24 Real Estate and Venture Capital Portfolio Management, it is seen that the Orange Blossom Fund provided 161%, A1 Fund 319.7% and Primo Fund 171.8%. These returns are well above inflation and represent several times the average yield on deposits, real estate and rentals.

If you wish, you can invest your money in our Real Estate Investment Funds and our funds, which consist of different types of real estate and have a risk/return balance, with a solid and reliable investment tool. If you wish, you can support the development of these companies by providing resources for their growth through our funds investing in companies with high potential through Venture Capital Investment Funds. With the growth of companies, you can also be a partner of the gains brought by rapid growth.

The fund is managed according to the principles of interest-free banking, and aims to provide the maximum return to its investor by purchasing the real estates that are especially urgent to be sold at affordable prices, with high profits when the conditions are met, in order to increase value, gain trading income and earn rental income. For this, the fund invests in different types of real estate.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

In particular, real estates that are in a difficult situation in the market are purchased at more affordable prices and sold at a higher price when favorable market conditions occur. In addition, it is possible to obtain rental income as well as increase in value and purchase and sale gain. It is an allocated fund, it is closed to investors other than the investor to whom the fund has been allocated.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund is managed according to the principles of interest-free banking and aims to generate income by investing in real estates of different qualities such as residences, factories, hotels, commercial units, with a high rental income in priority. The fund, which owns the industrial enterprise, also invests in real estates with favorable conditions all over Turkey.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

In particular, real estates that are in a difficult situation in the market are purchased at more affordable prices and sold at a higher price when favorable market conditions occur. In addition, it is possible to obtain rental income as well as increase in value and purchase and sale gain. It is an allocated fund, it is closed to investors other than the investor to whom the fund has been allocated.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund is managed according to the principles of interest-free banking and invests in agricultural production areas for both real estate acquisition and production. Investments made in the locations where the most efficient production is made according to the selected product type, besides adding value to our country's economy and farmers through agricultural production, also contributes to employment and promises attractive returns to fund investors.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The fund is managed according to the principles of interest-free banking and aims to maximize the participation share values of its investors by investing in all kinds of real estate such as land, land, residences, shops, schools, hotels, hospitals in order to earn trading income and rental income.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The fund is managed according to the principles of interest-free banking and the investment strategy of the fund; Value increase, especially rental income, is to generate business income. For this purpose, the fund purchases land, buildings or independent sections and sells the said real estates when they reach the targeted profitability.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund's investment strategy is to increase value, gain on trading and earn rental income, and for this purpose, lands, buildings or independent sections will be purchased.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund's investment strategy is to increase value, gain on trading and earn rental income, and for this purpose, lands, buildings or independent sections will be purchased.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

It is an investment fund that revitalizes the Çanakkale region and evaluates agricultural lands.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The fund is managed according to interest-free banking principles, and its investment strategy is to obtain trading profits and rental income and to purchase lands, buildings or independent sections for this purpose.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund's investment strategy is to obtain value increase, trading income and rental income, and for this purpose, lands, buildings or independent sections will be purchased. It is a dedicated fund and is closed to investors other than the investor to whom the fund is allocated.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

It is a fund that prioritizes land and also invests in housing, commercial investment units and projects.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund's investment strategy is to obtain value increase, trading income and rental income, and for this purpose, lands, buildings or independent sections will be purchased.

Participation in the fund portfolio may also include real estate investments that comply with trade and finance principles, non-interest-based money and capital market instruments, and investment fund participation shares.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund invests in non-public companies that have high growth potential and need to strengthen their financial structures, and the main sectors it targets are; electronic commerce platforms, online sales, payment and collection systems, domestic and international cargo, logistics, storage, transportation and transportation. All kinds of support is provided by the fund for the growth, branding and opening up of the venture companies invested in, and it is aimed to reflect the high returns to be obtained by extracting new values from the entrepreneurship ecosystem to the sector.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The Fund invests in non-public venture companies that have high growth potential and need to strengthen their financial structures, and the main sector it targets is information and technology. The purpose of the fund is to enable IT companies producing technology, CRM and software services in the SME segment to reach more companies and to support the rapid growth of SMEs. The growth of venture companies in this potential sector will enable direct fund and fund investors to obtain high returns.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

Managed according to the principles of interest-free banking, the fund invests in venture companies with high potential operating in the food, livestock, mining, energy, health, transportation, manufacturing and retail sectors, and will be able to invest in other sectors.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

Managed according to the principles of interest-free banking, the fund invests in venture companies with high potential operating in the food, livestock, mining, energy, health, transportation, manufacturing and retail sectors, and will be able to invest in sectors other than these sectors. In the selection of the company, the criteria of being a competitive company with the power to create brand value and the potential to develop value-added products and having gained experience in the sector are prioritized.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

The sectors that the fund aims to invest in are software and information technologies.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

Fonun yatırım yapmayı hedeflediği başlıca sektörler bilişim ve teknolojidir. Başta bu sektörlerde olmak üzere start-up projeleri gerçekleştirmek üzere faaliyet gösteren şirketlere yatırım yapmayı hedeflemektedir. Fon, bu sektörler dışındaki sektörlere de yatırım yapabilecektir.

Getirisi

Son 9 Aylık

Son 12 Aylık

Açılıştan

17+

Fon

110+

Yatırımcı

1000+

Yatırımlarımız

Latest News

- 27 09 2024

Price Action Nedir ve Nasıl Çalışır?

Price Action nedir ve nasıl yapılır? Bu içeriğimizde detaylarıyla cevaplandırıyoruz.

Devamı

- 16 08 2024

Finansa Analizi Nedir?

Finansal Analiz Yöntemleri Finansal analizde kullanılan yöntemler, şirketin mali durumu hakkında derinlemesine bilgi sağlar.

Devamı

- 16 08 2024

Disponibilite Nedir? Bankacılık Sektöründe Önemi ve Detayları

Disponibilite nedir, disponibilite kavramının bankacılık sektöründeki önemi nedir, hepsi bu içerikte!

Devamı